Financing Your New House

Financing Your New House

Chapter 3 of How to Build Your Dream Home © 2020 InspectApedia.com

- POST a QUESTION or COMMENT about how to identify the architectural style of buildings and building components

How to finance an owner-built home.

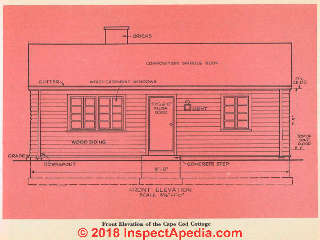

This article series provides an updated version of Hubbard Cobb's Your Dream Home, illustrated by Sigman-Ward, first published by Wm. H. Wise & Co. New York, 1950.

InspectAPedia tolerates no conflicts of interest. We have no relationship with advertisers, products, or services discussed at this website.

- Daniel Friedman, Publisher/Editor/Author - See WHO ARE WE?

Financing the Owner Built Home

This is Chapter 3 of BUILD YOUR DREAM HOME at InspectApedia.com - online encyclopedia of building & environmental inspection, testing, diagnosis, repair, & problem prevention advice.

This is Chapter 3 of BUILD YOUR DREAM HOME at InspectApedia.com - online encyclopedia of building & environmental inspection, testing, diagnosis, repair, & problem prevention advice.

This web page is also available as FINANCING THE NEW HOUSE [eBook] or as a PDF image at FINANCING THE NEW HOUSE [PDF] original page images

In spite of the fact that by building your house yourself, you can save over 60 per cent of the total cost, the chances are that you are going to have to borrow money to buy some or all of the necessary materials.

Of course, this is not true in all cases. Some home builders will have enough money saved in the form of saving accounts, war bonds, etc., to pay for all the required materials as well as for any experienced labor that may be necessary".

This is the perfect set-up, for when the house is finished, it is all yours, and there are no mortgage payments to worry about in the future.

Pay as You Go

Some builders may prefer the “pay-as-you-go method.” Here you pay for the materials as they are used out of your weekly pay check. IVhen the house is finished, it’s all yours. But there are several drawbacks to this method. First, the work often goes very slowly because you may not be able to buy certain needed materials until you get your next week’s or month’s pay check. Another point is that you may be tempted to use less

expensive and, often, inferior materials because the few dollars involved can make so much difference in how you eat for the next week. Then there is the question of delivery. Most local lumber yards will not make a special trip just to deliver a few pieces of studding or a bundle of shingles.

Unless you can pick up the materials yourself, you may have to wait until there is a delivery coining your way, when your materials can be included and brought out. And, as everyone knows, there is often a reduction in price when large purchases are made.

Loans

For those who do not have the necessary cash on hand to buy their materials outright, and do not care to pay as they go along, the solution is to get some lending institution to finance the venture.

There are relatively few homes built today on which some of the financing is not handled by one type or another of lending agency.

The man who builds a $5,000 home and the man who builds a $50,000 home will probably both get some of the money to build from a bank, savings and loan association, building and loan association, mortgage loan company, or other private lender. In return for the money to build his house, the owner gives to the lending agency a note promising to pay the sum back in a certain length of time, together with interest. The house and the land on which it is built are put up as security for this note. This is a mortgage. Many people are afraid of mortgages, possibly because thev saw too manv old-fashioned

HOW TO GET A MORTGAGE

Obtaining a mortgage is something else again. Suppose, for example, you have the plot of ground and want to build a home yourself. You have no money to put into the place, but you are willing to do the work. Let us assume that the cost of the materials will be $3,500 and the value of the finished house will be $8,750.

It would appear on the surface that any lending agency in its right mind would jump at the chance to get an $8,750 house as security on a $3,500 loan. The trouble is that the house isn’t built yet and the lending agency isn’t interested in the possibility of having to foreclose a mortgage. It is muchmore interested in having the loan repaid and receiving the interest. This is what it is in business for. The lending agenc}' will probably not show much interest in your proposition until it has checked into the various risks involved. First of all, it will want to find out if you are a responsible person who, once a job has been started, will finish it.

A house that is only half finished after a year or so of construction is of little value to anyone. A person may get enthusiastic about building his own home, start work, and then lose interest after he finds that it cannot be finished over night. The only way the agency could get back its investment would be to finish the house so that it could be sold, and this, coupled with poor workmanship on the part of the original builder, may put the price of the finished house far beyond its actual value.

movies in their youth, in which the villain foreclosed the mortgage on the old homestead and drove the heroine and her parents out into the snow storm. Despite the hero’s last-minute arrival with the necessary money, the idea that a mortgage is bad was firmly implanted in their minds. Unless you have some other method of financing your home, you will end up with a mortgage of one sort or another, and if everything is in order from the beginning, you will have no worries.

If you have a member of your family who is in the construction business, or even a friend, it will probably help, for this will reassure the agency that if you get into a spot, you will be able to call on free professional advice.

Apart from worrying about whether or not von will complete the house, the lending- agency will also check to see if vou are able to meet the installmentsand interest on the mortgage. It willcheck into your financial background to see if you have a reputation for meeting your financial responsibilities. It will probably also want a summary of your present financial position, which will include the amount of your income, for whom you work and how long you have worked there, the amount of money you owe, the value of your insurance policy, and the amount of money you have in savings such as bonds, saving accounts, stocks, etc. In other words, it will want to know about all your financial transactions.

If You Have No Cash to Invest in the House

If it finds that you are a favorable risk, the next question will be what amount of cash you intend to invest in this venture. Most hanks today do not care to finance an entire house without the owner’s putting up some cash, but in your case you have no money to put up, only your labor. In this case, the bank or agency will probably say, “Get started on the place so that we know you mean business. When you have the foundation or frame up, come backhand we’ll see what we can do for you.” This leaves things pretty much up in the air. The bank won’t lend you money until the house is started, and you can’t start the house until you have some money to buy the necessary materials. The thing to do now is to go to the lumber yard or -wherever you are going to buy the materials and explain the situation to them.

If you have a good responsible record, they will get in touch with the bank and talk things over.If the decision is that you are really in earnest and are going to build house, and a good one, the lumber yard will advance you the materials to get the job started, by extending you terms of thirty or sixty days on your purchase.

necessary

Once you have the foundations in, you go back to the bank with your plans and a list of the materials you are going to need, together with their cost. Now the bank has something concrete to go on. The house is under construction. The bank has looked over your work so far and has found it satisfactory.

The officials can assume from that fact that the rest of the job should be satisfactory. They can see from the plans and the work you have done so far what the finished house should be worth, and exactly how much the materials for it are going to cost. And, lastly, they see that you have invested something in the house—your labor.As a result, they will probably be willing to invest the necessary funds so that the job can be finished.

With an arrangement of this sort, it is possible for you to start building without any initial outlay of cash on your part at all. Naturally, if you have some money, you can pay for the necessary materials to get the job started and get the rest of the money from the bank when construction is under way. Some home builders have been able to go one step further than this.By investing some money of their own in the initial construction, they have been able to get enough money from their local bank to buy the materials they need, and also to pay themselves a small salary while they work. Thus they can devote full time to finishing the house with enough money to live on.

This is a fine arrangement if you are in a profession or trade where you can take a few months off and then go back again at your former salary.But most amateur house-builders will have to hold on to their jobs and work on the house evenings, on the week-ends or during their vacations.

If you have to borrow money to complete your house, it is not always necessary to take out a mortgage. If the sum required is not too large, you can take out a personal note or borrow on your car.KINDS OF MORTGAGES

For those who will require a mortgage, there are certain terms as well as facts that should be known and understood. First, there is the principal, which is the amount of money that is lent. If you borrow $3,500, this is the principal.

Next, there is the interest. This is the money you pay for the use of the principal. Interest is expressed in a percentage and will vary from place to place and from time to time. The interest may be paid yearly or at some other interval, whichever way you and the lending agency agree upon.

The Straight Mortgage

There arc two types of mortgages, a straight mortgage and an amortized mortgage. A straight mortgage is one where you promise to pay at a certain date the full amount of the loan. You may pay the interest yearly, semi-annually, or quarterly, but you make no payment of the principal until the due date. These are short-term mortgages running for five years, and they cannot be for more than 50 per cent of the appraised value of the property.

The obvious drawback to this type of mortgage is the possibility that you will not be able to raise the necessary funds on the date that the mortgage comes due. Very few of us have on hand cash equal to 50 per cent of the value of our homes. Under usual conditions, the lending agency will renew the mortgage for another term, but it may require that you pay something on the principal. But if conditions are unusual, if, for instance, there is a depression, the agency may require you to make the full payment of the principal and if you can’t, then the mortgage is foreclosed.

When a mortgage is foreclosed, the ownership of the property passes to the agency holding the mortgage. The property is put up for public sale, and the agency lending the money is paid off from the money received for the house. If there is anything left over, the original owner receives it.

Another drawback to the straight mortgage is that, because it can be only for 50 per cent of the value of the house, it is often necessary to obtain additional funds. This is done through a second mortgage.

If you use a straight mortgage to finance your home, be sure that the date on which it falls due is in writing and is not “on demand.” If you have a demand mortgage, you can be called on to pay the full amount of the principal at any time the lending agency asks for it.

The Amortized Mortgage

This is the method used in most of the home financing done today. This type of mortgage runs for as long as it takes to pay off the principal. Payments are made monthly or every three months. Each payment is apportioned among the interest, the taxes, and the principal. In successive payments, the amount allotted to the interest decreases and that allotted to the principal increases because, as the sum is reduced, the interest becomes less and less. However, the amount of the individual payments remains the same. With each payment your equity in the property grows, and this is important in the event that for one reason or another you are unable to meet a payment or so. If you have sufficient equity, there will probably be no trouble.

An amortized mortgage cannot be renewed, nor can the unpaid balance be called in on demand.

Once you have made arrangements with a lending agency to get an amortized mortgage, your next problem is to work out a method of repayment. Everyone likes to get the mortgage paid off as quickly as possible; everyone likes to have the monthly payments as small as possible; and everyone likes to make a minimum down payment on the expenses of their plot and future home. The trick, then is to balance these requirements to your greatest advantage.

A good rule to follow^ in making the down payment is to pay as much as you can possibly afford at this time, still keeping enough savings in reserve to meet emergencies such as sickness. There is no point to making a large down payment and then not being in a position to pay the first installment. Now there remains the unpaid balance, and the payment of this will be spread out over a period of years in monthly installments.

The larger the installments are, the sooner the loan will be paid off. By paying the loan off in ten years rather than twenty-five, you save a good deal of interest charges. On the other hand, it is best not to use over 25 per cent of your monthly income for housing because, in these days of rising living costs, more and more of the family income must go for food and clothing.

There is another factor that must be considered in working out a repayment budget and this is your present and future earning capacity. If you are just getting started in your profession, von may have to start out with a very low monthly installment and a long term loan. As your income increases, you can re-budget your payments so that they are larger and in keeping with your greater earning power. You can also pay off the balance of the unpaid mortgage, but there is usually a penalty involved in this. If your income is more or less set at this time, you should take into consideration your estimated earning power over the years until the mortgage has been discharged.

For example, if you are thirty-five now and you have a twenty-five year mortgage, the last payment will fall due when you are sixty. At this age you may very well not have the earning capacity that you do today. In this event, you should try to figure out a payment plan whereby you will have discharged your mortgage before there is any decline in your earning capacity. Your local bank or lending agency will be able to give you a lot of good sound advice in working out a repayment plan.

As a builder-owner you should not have the same difficulties in working out a repayment plan as someone who is purchasing a finished house or one that is going to be built professionally, because you will not need anywhere near the amount of money that he will. You may be able to get sufficient funds for the materials by borrowing on your insurance or from a private individual.

Private loans are perfectly all right if the interest rate is not too high, and the date of payment is in writing. Demand notes are not good. If the lender should get into a tight spot, you might have to pay up in full at a time when it is impossible. Before you knew it, you would have a court action on your hands. Don’t get the idea that just because you borrow from a friend you can avoid difficulties of this sort. If you make a private loan, even with your best friend or a close relative, be sure all is in order, and in writing.

FHA LOANS

Many home-builders today borrow money under the FHA plan. The Federal Housing Act passed in 1934 created government insurance on home-financing loans and made it available to home-financing institutions. The act also created the Federal Housing Administration to administer the new law. The FH A does not lend the money to home-buyers or home-builders.

A person who wants to borrow money to buy or build a home must get it from a private lending agency approved by the FHA. The FTIA simply insures to the approved lenders that they will be repaid fully for loans that they make, in conformity with sound standards, to home-buyers and home-builders. The effect, therefore, is to make more money available to people who wish to borrow it, since the risk is removed for the lender.

Every person who earns a steady income from a job or business and who has a good credit reputation can obtain FHA insurance on a loan to buy or build a home of his own, provided the house is judged to be structurally acceptable, is a sound, long-range value, and is priced within his means.

For the person who wants to buy or build a new home for himself, the FHA will do the following, if the house is built with its inspection and meets its requirements:

If it values a home at up to $6,315, the FHA will insure a loan on it for as much as 95 per cent of its value. If, for instance, the value is $6,000, the buyer can obtain FHA insurance on a loan of $5,700. Loans in this value range must be paid off in thirty years.

If it values the home between $6,315 and $11,000, the FHA will insure a loan on it for as much as 90 per cent of the first $7,000 and 80 per cent of the next $4,000. For instance, if the value is $10,000, the borrower can obtain FHA insurance on a loan of $8,700. This amount is the total of $6,300 for which he can be insured on the first $7,000 of the valuation, and $2,400 for which he can be insured on the remaining $3,000 of the valuation. Loans in this value range must be paid off in twenty-five years.

If it values the home at between $11,000 and $20,000, the FHA will insure a loan on it for as much as 80 per cent of the value. For example, if the value is $20,000, the home-buyer can obtain FHA insurance on a loan of $16,000. Loans in this value range must also be paid off in twenty-five years.

To secure the maximum percentage loans on a new home, plans must be submitted to the FHA before construction starts and a commitment to insure must be obtained. Otherwise, loans are limited to 80 per cent of the value. The interest rate on an FHA insured mortgage may not exceed 4 Vi per cent, plus an FHA insurance charge of % of 1 per cent on declining balances.

Considerations of the Property

In determining whether the FHA can insure the proposed mortgage loan, FHA gives consideration to the location of the lot and such related matters as suitability of the neighborhood, access to schools, and adequacy of utilities.

FHA has set up certain minimum property standards to determine whether the property is acceptable as security for an FHA insured-mortgage loan. It makes a valuation of the property based on long-term use. If construction is completed, an appraiser inspects the property and places a valuation on it, including the lot. If the property is proposed construction, plans and specifications are analyzed for conformity with FHA minimum property standards, and after an FHA appraiser has visited the site, valuation will be placed upon

the land and the proposed improvements when erected on the site. While the house is being constructed, the FH A makes three or more inspections.

Benefits to the Buyer

The precautions taken by FHA as insurer of the mortgage result in the following benefits to the borrower:

FIIA’s valuation of the property represents an objective estimate of its long-term value. This provides the borrower with a conservative guide in determining how much he should agree to pay under his purchase contract.

The examination of the relationship of monthly payments to the borrower’s present and anticipated income and expenses helps protect him from entering a transaction beyond his means. The FHA does not insure a mortgage un-

A GI LOAN

Many veterans are confused as to just what the so-called GI Loan for buying a house is all about. This is actually nothing more than a loan that is made by a private lending institution, such as a bank, and is guaranteed by the Veterans Administration. The government does not lend von any money; it merely insures your loan.

A GI Loan will guarantee up to 50 per cent of the loan, but the guaranteed amount cannot be more than $4,000. This loan may be used to buy, build, or improve a home. The loan must bear interest at a rate of not more than 4 per cent per year, and must be paid off in twenty-five years. In addition, the Veterans Administration pays to the lender, for credit to the veteran’s loan account, a sum equal to 4 per cent of the guaranteed portion of the loan. This credit is a gift to the veteran and not a loan. Veterans may apply for GI Loans until July 25, 1957.

Through the minimum property standards and inspections, the borrower benefits from an objective check and review^ of the property as to its basic construction and conformity to essential property standards. This is not, however, a guarantee of the house, but it does provide the borrower reasonable insurance that the property has met at least the minimum FHA requirements.

The table on Pg. 32, prepared by an official of the United States Housing and Home Finance Agency in Washington, show's you how much you must pay each month on homes valued from $6,000 to $20,000 that are bought with FHA-insured mortgages.

At this point, you may begin to wonder just what the advantages of this type of loan over an FHA-insured mortgage may be. In the first place, you get a low-er rate of interest. While this may not seem like a great deal, it can add up in twenty-five years or so. Another advantage of the GI Loan is less there appears a reasonable likelihood that the borrower can maintain the payments.

Table I FHA-INSURED MORTGAGES ON NEW SINGLE FAMILY, OWNER-OCCUPIED HOMES

(National Housing Act, Title II, Section 203)

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Decreases each year since the of 1% premium is based on the declining outstanding balance of the loan. 2 Assumed annual rate of $2 per $1,000 of appraisal value. 3 Assumed annual rate of $20 per $1,000 of appraisal value. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table II LOAN TERMS ON NEW OR EXISTING SINGLE FAMILY, OWNER-OCCUPIED HOMES ASSUMING 100% LOANS AVAILABLE UNDER SERVICEMEN’S READJUSTMENT ACT, TITLE III, SECTION 501

($4,000 or of the loan, whichever is less, would be guaranteed by the Veterans Administration)

|

Maximum Monthly payment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1 Not reflecting VA gratuity payment to veteran’s loan account, amounting to 4% of the guaranteed portion of the loan. For example, on 36,000 loan, gratuity payment would be 3120 (4% of $8,000). 2 Assumed annual rate of $2 per $1,000 of reasonable value. 3 Assumed annual rate of $20 per $1,000 of reasonable value. * Down payment will be required if valuation of the home is less than price for which it sells. |

inspected by an inspector to be sure that these requirements are met. If your home has met the FHA requirements, that will be accepted for a GI Loan.

The table on Pg. 33 show's you how much you must pay each month on homes valued from $6,000 to $20,000 covered by 100 per cent GI Loans.

VA-FHA LOANS

80 to 95 per cent of the value of the home, depending on the value of the home. The GI Loan covers a second mortgage, which cannot exceed 20 per cent of the purchase price. Under the law, therefore, the veteran is entitled to obtain financing up to, but not exceeding, naturally, 100 per cent of the purchase price. In practice, however, down payments, somewhat lower in amount than would be required in either a straight FHA or straight VA loan, are commonly called for.

The table on Pg. 35 covers the payments under FHA-VA loans to veterans in the most inexpensive interest-charge combination possible.

that you do not have to make as large a down payment as you would on other types of loans, and you can prepay part or even all of your loan whenever you feel like it, without penalty. To get this type of loan, your property must meet with the Veterans Administration minimum property requirements and the property will have to be

COMBINATION

Under the provisions of the Servicemen’s Readjustment Act (the GI Bill) , a veteran of World War II may obtain a secondary loan up to 20 per cent (but not in excess of $4,000) of the approved purchase price or construction cost under a VA guarantee to cover all or part of the difference between an FHA-insured mortgage and the price of the house.

These secondary loans are guaranteed in full by the Veterans Administration. This is the only case in which additional financing may be added to an FHA-insured mortgage.

In effect, the FHA-insured mortgage is a first mortgage, covering fromCONSTRUCTION LOANS

Since you are planning to build your own home rather than purchase it, the plans outlined above must be modified somewdiat to fit your special case. To build a home rather than purchase it, it is necessary to obtain a “construction” loan from the bank before you commence building in order to meet costs of labor and material. In your case, it will be mainly material.

The Veterans Ad-ministration is authorized to guarantee construction loans for veterans. The Federal Housing Administration, however, does not insure construction loans as such on individual homes. However, a conditional FHA commitment on a permanent loan can be secured before you start construction, and will make it easier to secure a construction loan from the bank.

Table III LOAN TERMS ON NEW SINGLE FAMILY, OWNER-OCCUPIED HOMES, ASSUMING 100% LOANS AVAILABLE UNDER COMBINATION FIIA-INSURED FIRST MORTGAGE AND VA-GUARANTEED SECOND MORTGAGE

(National Housing Act, Title II Section £03; Servicemen's Readjustment Act, Title III Section 505a)

|

Appraisal - Monthly payment and Maximum loan Maximum Down Maximum-- | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1 Assuming FHA appraisal and YA reasonable value are the same.

2 Not reflecting \ A gratuity payment to veteran's loan account for first year only, amounting to 4% on YA guar

>anteed second loan. For example, on 86,000 loan, credit for the year would be 848 (4% of 81,£00). 3 Applies to FHA-insured first loan. Premium decreases each year since the }/i of 1% premium is based on the declining outstanding balance of loan. 4 Assumed annual rate of per 81,000 of appraisal value. 5 Assumed annual rate of $£0 per $1,000 of appraisal value.* Down payment will be required if valuation of the home is less than price for which it sells. |

required amount when the home is completed. By checking your plans before construction, and inspecting the home during construction, the FHA determines that the house measures up to the standards it requires of all homes on which it makes loans.

The disbursements on a VA-guar-anteed construction loan are made during the course of the construction of the home. The final execution of the FHA permanent loan, of course, is made only after the home is finished.All this simply means that the bank will be more willing to make a construction loan if it knows that the loan will be picked up by an FHA permanent financing loan when the house is completed. It is necessary to secure an FHA commitment before beginning construction so that you can be certain that FHA will insure a loan for the

THE LONG-RANGE VIEW

In the long run, the most important question in buying a new home is: Are you going to be able to keep it up once you have built it?

Experts in the mortgage field say that you should figure your monthly payments as the amount of rent you can afford to pay, and that your rent should be no more than 20 or 25 per cent of your monthly take-home pay. This figure should cover all the charges for interest, amortization of the mortgage, taxes, insurance, and maintenance.

Some experts suggest that you figure the yearly maintenance costs— which include painting, repairs, and similar expenses—at 1% per cent of the buying price. In the case of an owner-built home, this figure would be the appraised value. In other words, if the house is worth $10,000, the annual maintenance costs should be figured at $150. You will probably not spend that much every year, but it will average out. A house does not have to be repainted every year, for example, but when it is, the cost will probably be over the year’s average.

CHECKLIST ON FINANCING

Price ...........

Estimated Value . Amount of

Mortgage ... Interest Rate Term of Mortgage.

Prepayment Privilege ?Down Payment Closing Charges:

Title Search and Clearance. Legal Fees .............

Other Charges .........

TOTAL INITIAL COST

Monthly Payment on Mortgage . Monthly Payments on Taxes and Assessments .

Monthly Payments on Insurance--

Total Monthly Payment. ..

Upkeep and Repairs.......

Probable Cost of Fuel.....

Probable Cost of Utilities.. Taxes...................

TOTAL MONTHLY COST ..........

...

Continue reading at CUTTING COSTS, BASIC MATERIALS, NECESSARY TOOLS - next chapter in this book, or go to book contents at BUILD YOUR DREAM HOME, or select a topic from the closely-related articles below, or see the complete ARTICLE INDEX.

Or see these

Recommended Articles

- ARCHITECTURE & BUILDING COMPONENT ID - home

- ARCHITECTURE DICTIONARY of BUILDINGS & COMPONENTS

- ARCHITECTURAL STYLE & BUILDING AGE

- BUILD YOUR DREAM HOME

- CONSTRUCTION DICTIONARY

- GLOSSARY of BUILDING TERMS

- HOME CONSTRUCTION CATALOGS 1950

- KIT HOMES, Aladdin, Sears, Wards, Others

Suggested citation for this web page

FINANCING THE NEW HOUSE at InspectApedia.com - online encyclopedia of building & environmental inspection, testing, diagnosis, repair, & problem prevention advice.

Or see this

INDEX to RELATED ARTICLES: ARTICLE INDEX to BUILDING ARCHITECTURE

Or use the SEARCH BOX found below to Ask a Question or Search InspectApedia

Or see

INDEX to RELATED ARTICLES: ARTICLE INDEX to BUILDING DAMAGE, DISASTER, REPAIRS

Or use the SEARCH BOX found below to Ask a Question or Search InspectApedia

Ask a Question or Search InspectApedia

Questions & answers or comments about how to identify the architectural style of buildings and building components

Try the search box just below, or if you prefer, post a question or comment in the Comments box below and we will respond promptly.

Search the InspectApedia website

Note: appearance of your Comment below may be delayed: if your comment contains an image, photograph, web link, or text that looks to the software as if it might be a web link, your posting will appear after it has been approved by a moderator. Apologies for the delay.

Only one image can be added per comment but you can post as many comments, and therefore images, as you like.

You will not receive a notification when a response to your question has been posted.

Please bookmark this page to make it easy for you to check back for our response.

IF above you see "Comment Form is loading comments..." then COMMENT BOX - countable.ca / bawkbox.com IS NOT WORKING.

In any case you are welcome to send an email directly to us at InspectApedia.com at editor@inspectApedia.com

We'll reply to you directly. Please help us help you by noting, in your email, the URL of the InspectApedia page where you wanted to comment.

Citations & References

In addition to any citations in the article above, a full list is available on request.

- In addition to citations & references found in this article, see the research citations given at the end of the related articles found at our suggested

CONTINUE READING or RECOMMENDED ARTICLES.

- Carson, Dunlop & Associates Ltd., 120 Carlton Street Suite 407, Toronto ON M5A 4K2. Tel: (416) 964-9415 1-800-268-7070 Email: info@carsondunlop.com. Alan Carson is a past president of ASHI, the American Society of Home Inspectors.

Thanks to Alan Carson and Bob Dunlop, for permission for InspectAPedia to use text excerpts from The HOME REFERENCE BOOK - the Encyclopedia of Homes and to use illustrations from The ILLUSTRATED HOME .

Carson Dunlop Associates provides extensive home inspection education and report writing material. In gratitude we provide links to tsome Carson Dunlop Associates products and services.